Dec 2011 - Stock Market - Difference between Traders and People

Getting too much worried about increasing the gas prices or plunging home prices? Let it be any direction the prices are moving, once they reach an extreme level, market correction is inevitable. Traders often take advantage of the extreme price level and bet on the market.

Consider the case of increasing the gas prices. As long as you are a consumer, you need to worry. However if you are a owner of gas station, then you can be very happy about increasing the gas prices. Always it depends on which side you are on. Smart and professional traders always try to be on the right side on making money. Anticipating of increasing gas prices makes the traders to taken long positions on oil futures or big oil companies such as Exxon Mobiles, Chevron, etc.

Google is currently dominating the online market and Apple is dominating the Tele communication market. Google or Apple can go bankrupt in the future, lets say in 10 years? If we conduct a poll of this question between a set of people and traders, the result would be as follows: Around 80% of people believe the companies would never file bankruptcy even in 20 years. Around 80% of traders believe that even they are good companies, can go bankruptcy given the long duration and the future is unknown.

People always do look into the recent past and project the future based on that indefinitely. We have seen so many bubbles and burst (.com, housing, etc). The current bubble might the FED interest rate.

When the market topping or bottom happens, it would not be a single day event. It is a process in which different asset classes would have its own timing for forming the top or bottom. Collectively market index would let us know a single date for forming the top or bottom. But if you notice, when the market index formed bottom, some asset classes might have already started its up turn a few days ago and some other might continue deteriorate for a while.

Real Estate Pricing in India and USA

USA already experienced a pricing collapse in housing market. Even then people in India would strongly believe that housing price would never get collapse because of India is a developing country, a booming market and population. Nevertheless real estate pricing collapse in India is eventually going to happen. It is just a matter of time...

Japan always the world leader of economy

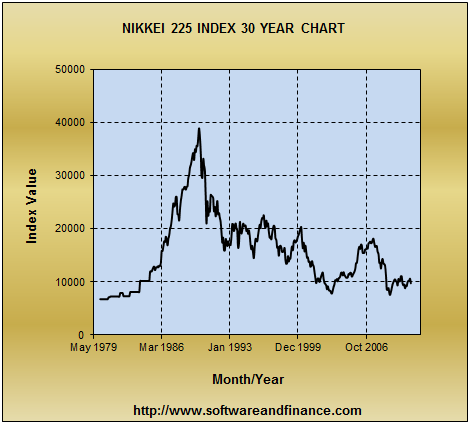

Most people do know that NIKKEI 225 is the index for Japanese Stock Market and it is trading around 9000 to 16000 for the last 10 years. Only very few people know that NIKKEI 225 was trading above 38,000 before 20 years. Note: 38,000 is not a misprint. The all-time high for NIKKEI stock index is set on December 29, 1989 at 38,957.44 (intra-day high).

On March 10, 2009 the Nikkei 225 stock index reached a 27-year low of 7054.98. Once the Japanese stock market collapsed and then recovered, it would never be able regain even its 50% of its all time high. Currently Nikkei is trading 73% down from its all time high.

What would be reason behind the collapse for Japanese stock market during 1989? It is housing bubble...! What we experience and talk about this in USA and other major countries. Let’s analyze the housing price comparison in Japan in late 1980s.

Real Estate Price Bubble in Japan during late 1980s - Ginza district, Tokyo.

Today and even 30 years ago the most expensive city in the world is Tokyo, Japan. Ginza district in Tokyo is considered as very expensive always. In 1989, one square foot of land in Ginza District in Tokyo was selling over US $ 93,000. It would be close to 1 million US dollars per square meter. This figure is not a misprint and but it is still unbelievable. The scariest thing happened was prices have slumped to less than 1% when the real estate collapse happened. Currently in 2011, one square meter of land in Ginza District is US$ 100,000 which has still lost 90% of its value from its all time peak set during 1989. But still Ginza District is considered as the most expensive real estate in the world and currently holding 10% of value from its peak.

Lesson learned from Japan for rest of the world

Based on the history in Japan which experienced 99% collapse in housing prices, there is no surprise, if the real estate in other countries including USA, India can collapse by 50%. When an asset class experiences a bubble, the correction takes place. Usually the correction would end only when it reaches below its fair value of the market.

With respect to S&P case shiller index for US composite 20 cities, housing prices need to collapse at least by 25% from its current value when it reaches the final bottom that would be less than the market fair value compared to last 10 years of inflation history. This would be hard for the people to believe and expected thing for a professional trader.