Jan 2012 - Economics - Top 10 Reasons Why Real Estate Bubble would crash in India

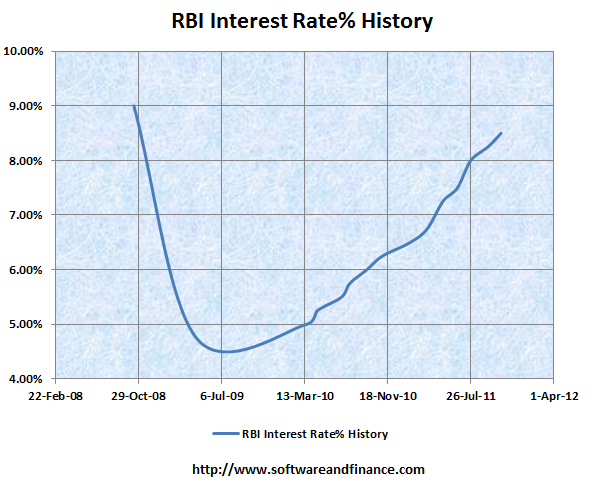

In Oct 2008 RBI Interest rate was set at 9.0% and the inflation was around 6.0% at the time. To accelerate the growth, RBI slashed the interest rate like anything almost 50% in 6 months time frame. In April 2009, RBI set the interest rate at 4.75%. It triggered the inflation like anything and also created a credit bubble. In 2009-2010, Inflation was its highest level in the last 15 years crossed more than 12.00%. From March 2010, RBI has started really worrying about the inflation rate and started rising the interest rate to tackle the inflation. Currently the interest rate is at 8.50% as of Oct 25, 2011 and inflation came down to 8.00% from double digit.

Inflation is to create Housing Bubble?

Keeping the key interest rate row accelerates the growth and by following this strategy would help for growth, no doubt. But the problem keeping the interest rate low often creates bubble – let it be credit bubble or housing bubble. If the interest rate was low, many middle class income people buy homes at floating interest rate as it can be afforded for them and hence creates artificial demand in the housing market. As long as the interest rates keep going down, the sellers take advantage of the low interest rate to increase the price and hence the housing bubble was created in India

Top 10 Reasons Why Real Estate Bubble would crash in India

Here are the top reason why real estate bubble would crash in India.

1. Home prices are very highly overvalued.

2. RBI Interest Rate Was currently at 8.50%

3. Most people do not 20 years or 30 years fixed rate.

4. Inflation is sky rocketing in India with double digit in the last couple of years.

5. Home guideline values are getting increased that discourages the speculators in the housing market.

6. House registration fraud is getting conrolled with computer based systems.

7. Downturn in the global economy including USA, Europe and other emerging market regions.

8. Unemployment situtation in India would be a problem in the coming year.

9. Aniticipating high number of foreclosures as their floating rate percentage are getting increased year over year.

10. Indian Stock Market entered into bear market territory which reflects the economic situation in India after 6 months to 1 years is confirming the upcoming crash in India.

Author: Kathir

Email: kathir@softwareandfinance.com