Stock Market - FOMC - Interest Rate After Election?

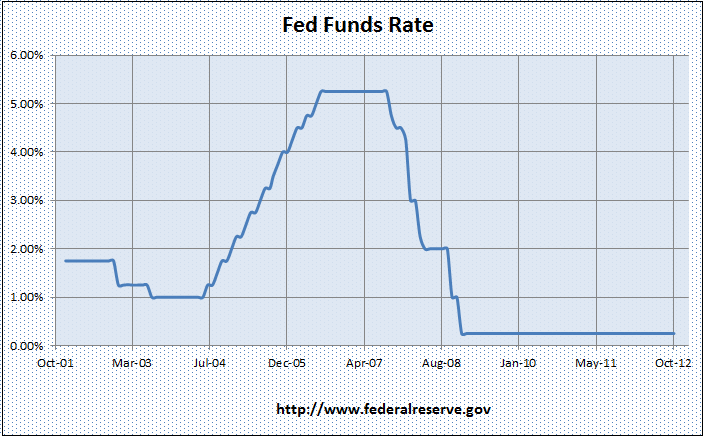

Here is the chart for Fed Funds Rate for the last 10 years. By end of 2008, Fed decided to keep it rates inter bank lending rate as 0 - 0.25. By now, it has been around 4 years, it would have created a great credit bubble in the financial industry.

Still how long it can keep its rate lower? May be until the US presidential election? May be yes. Because of surging inflation, Fed has to increase the interest rate. Otherwise, market will switch its long term treasury investments to stocks. That can lead a huge sell off in treasuries and hurting the mortgage rates. However because of high inflation, even though the interest rates go up, the housing prices will be stable or may have some little negative impace in some areas which is hardly noticable in the broader market.

Nothing can be static in life and so interest rates have no option except to move up from this point. But the question is when? Might happen after the election whoever wins.