INR (Indian Rupees) To Become Stronger Currency

INR (Indian Rupees) will get strengthen further across all major currencies. For the last over decade INR went down across other currencies because of hyper inflation and higher growth. Noe the growth is saturating, INR will gain its value in the coming years.

The current conversion rate is around 60 for USD to INR. INR to become a stronger currency since it is undervalued for a long time with hyper inflation in the last over a decade. When GDP for India slows down and real estate market collapses, the demand for rupee will be huge. Since Indians have been betting on the direction that Indian Real Estate will not go down, it would be a surprise for them when the home prices does not move up year over year.

Stronger INR will weaken the commodity prices which in turn collapses the real estate market. There are two key indicators that will determine when will the real estate market will collapse?

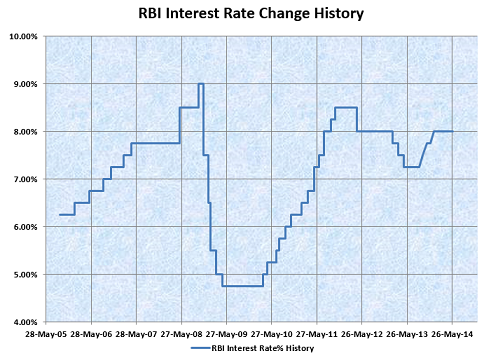

1. Interest Rate

2. Unemployment Rate

The interest rate will not move down further since it will trigger another wave of hyper inflation creating a serious disaster to overall economy in India. Rising the interest will trigger collapse the hosuing market which upper middle class and high class people are not interested in. It is expected to stay at the current level by looking for a direction. However this situation will change in the coming months when foreign investors see no growth in India and pulls the money out of the market.

Since Nasdaq is in the bubble territory, when it collapses, it can create a wave of lay offs in foreign countries and in India. This situation will stop NRIs from buying properties in India can contribute to significant collapse in Indian Real Estate Market.

When people see no growth in Real Estate, Stock Market and Commodities, they will move on to holding Indian Rupees since it is way undervalued against major currencies.