Nifty Weekly Forecast From Oct 24, 2011 - Rangebound Trading Continues.. (Expected Trading Range: 4747 - 5153)

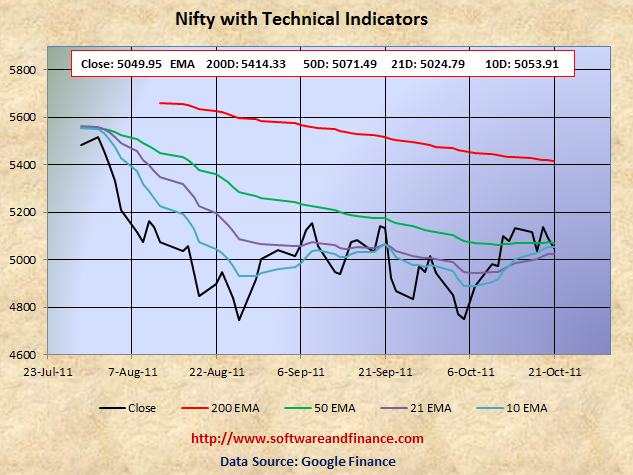

Oct 21, 2011 - Nifty Closed today at 5049.95 which is 82 points down from the last week close of 5132.30 on Oct 14, 2011. Nifty was trading in between 5033.95 and 5160.20 which is about the swing of 126 points.

To watch Nifty Index in google finance, visit the following link:

NSE Index in Google Finance

To watch Nifty Index in yahoo finance, visit the following link:

NSE Index in Yahoo Finance

Last Week Analysis - Bear Market Rally Collpasing and Range Bound Trading

Nifty had a bumpy ride last week and lost about 1.6%. It is not a clear buy signal for conservative investors. As the 30 years yield of US treasuries bottomed, many investors started coming out of treasuries and they are not sure of what to do with the money. Consequently they have started invested again in US Stocks. S&P 500 tried to regain its 200 days of EMA 1240 and end up in making last week high of 1239.03 which is just 1 point below its 200 days EMA. This is the main cause of the last week rally in US Market. Indian markets and other Asian markets tried to catch up US market trends. Again stocks are vulnerable of steep pullback.

Note: US Interest Rate Bottom retesting will happen again in the coming months.

Last Week Low: 5033.95 (Refer to the strong support level 4800, would be broken in the coming weeks)

Last Week High: 5160.20 (Strong resistance level build around 5100 range)

Looking at the chart below clearly indicates the declining 200 days EMA and 50 days EMA. It means that market will tend to go lower in the long term with occasional bear market rally. In this market, buy and hold strategy would fail. We need to follow the key technical support levels and play with swing trading strategies. Swing trading involves high risks when range bound trading completely broken. Betting on volatility with negative bias would yield a lot in this market. Institutional investors are smartly exiting their long and short positions based on the market condition and keep switching their assets. When treasuries are reaching almost a top level, then institutional investors will exit from the treasuries and t-bills and switch back to undervalues banking and finance sector. This is the main cause of the rally in the last two trading sessions.

Nifty technical levels suggest betting on volatility as key support level to be broken in the coming weeks.

If you are conservative investors, then exit from your long positions with the recent rally and hold currency or indian T-Bills. The key resistance level for Nifty came down to 5100 and the key support level for Nifty is 4960, 4800 and 4747. The next key resistance level is 5225.90 and 5428.49, which is very much unlikely we will reach these level. Market is getting ready for imminent correction now.

Nifty might experience a double dip in Indian Market along with world market correction in the long term (about 2 years). With double dip, Nifty is expected to touch 2600 levels set on Oct 2008 and Mar 2009. Wait for some more time to get more clues on "double dip on Nifty"

For Speculators and Intraday Players - Betting on Volatility (Option Straddle / Strip)

1. Buy 1X times of (OTM) call options and 2X time of (OTM) put option - known as option strip.

2. Buy 1X time of call and 1X time of put option with the same strike price - known as option straddle.

Note: OTM - means Outside the money.

Technical Indicators

10 days EMA: 5053.91

21 days EMA: 5024.79

50 days EMA: 5071.49

200 days EMA: 5414.33

Next Resistance Levels:

Strong Resistence level at: 5153.25 - Set on Sep 09, 2011

Resistence level at: 5225.80 set on Feb 10, 2011 and Jun 20, 2011

Strong Resistence level at: 5414.33 - 200 days EMA

Next Support Levels:

Minor support level at 5024.79 - 21 days EMA

Minor support level at 4940.95 set on Sep 13, 2011

Strong support level at 4806.75 set on May 25, 2010

Strong support level at 4747.80 set on aUG 26, 2011

Strong support level at 4718.00 set on Feb 05, 2010

Strong support level at 4003.90 set on Jul 10, 2009

Strong support level at 2620.10 set on Mar 06, 2009 Will reach here with double dip

Strong support level at 2584.00 set on Oct 24, 2008 Will reach here with double dip

Posted on Oct 23, 2011

|

|

|

|

|

|

|

|